Profitability Factors in Mining (Electricity, Hardware Costs)

Top Profitability Factors in Mining: Electricity & Hardware Costs Explained

Content Introduction:c are crucial for determining the potential returns of cryptocurrency mining operations. Understanding these factors and how they influence mining outcomes can help miners make better financial and operational decisions.

1. Electricity Costs

- High Energy Consumption: Mining rigs, especially ASICs and GPUs, require substantial power to operate around the clock. The more powerful the hardware, the higher the energy consumption.

- Location-Based Costs: Electricity rates vary by region, and mining in a country or state with low electricity costs can significantly improve profitability. For example, areas with access to renewable energy, like hydroelectric or geothermal power, often offer lower rates.

- Optimizing Power Usage: To maximize profits, many miners look for ways to reduce energy consumption, such as using energy-efficient hardware, implementing cooling systems, and operating during off-peak hours when electricity rates are lower.

- Renewable Energy Options: Some miners are turning to renewable energy sources, such as solar panels or wind turbines, to cut down on electricity costs and reduce environmental impact.

How Electricity Costs Affect Profitability in Mining

Electricity is the most significant operating expense for cryptocurrency miners. The costs can vary depending on factors like the miner’s location, energy source, and equipment efficiency.

- Energy Consumption and Efficiency: High-performance mining rigs, like ASIC miners, consume significant amounts of power. Models with higher hash rates tend to use more energy, impacting the overall cost-effectiveness of the mining operation.

- Electricity Pricing: Global electricity prices vary widely, affecting mining profitability. Regions with low electricity rates, such as parts of Asia and South America, are often more profitable for mining operations.

- Renewable Energy Sources: Miners are increasingly turning to renewable energy options, such as solar or hydroelectric power, to lower costs and reduce their environmental footprint.

Managing Hardware Costs to Boost Mining Profitability

The initial investment and ongoing maintenance of mining hardware are other major considerations.

- Upfront Investment: Purchasing high-quality mining equipment can be costly. ASIC miners and GPUs vary in price, and newer, more efficient models often come at a premium.

- Depreciation and Upgrades: Hardware tends to lose value over time as new, more advanced equipment becomes available. This depreciation can impact profitability if not factored into the long-term investment plan.

- Maintenance and Lifespan: Keeping mining rigs operational requires regular maintenance. Cooling systems and component replacements are necessary to ensure the hardware runs efficiently and doesn’t lead to downtime.

Strategies to Optimize Mining Profitability

- Location Matters: Establish mining operations in areas with lower electricity costs or favorable energy policies.

- Invest in Energy-Efficient Hardware: Select mining equipment known for a balance between energy consumption and high hash rates.

- Explore Renewable Energy: Incorporate renewable energy solutions to minimize electricity costs and promote sustainability.

- Regular Upgrades and Planning: Stay informed about new hardware releases and plan for potential equipment upgrades to maintain competitive profitability.

In short, electricity cost is a major factor in mining profitability, and finding ways to reduce energy expenses can make a substantial difference.

One of the most significant factors affecting mining profitability is electricity cost. Mining consumes a lot of energy, so where you mine and the cost per kilowatt-hour (kWh) can make a big difference:

[Section 2: Hardware Costs**

The initial cost of mining hardware is another significant investment in the mining process. Here’s what to consider:

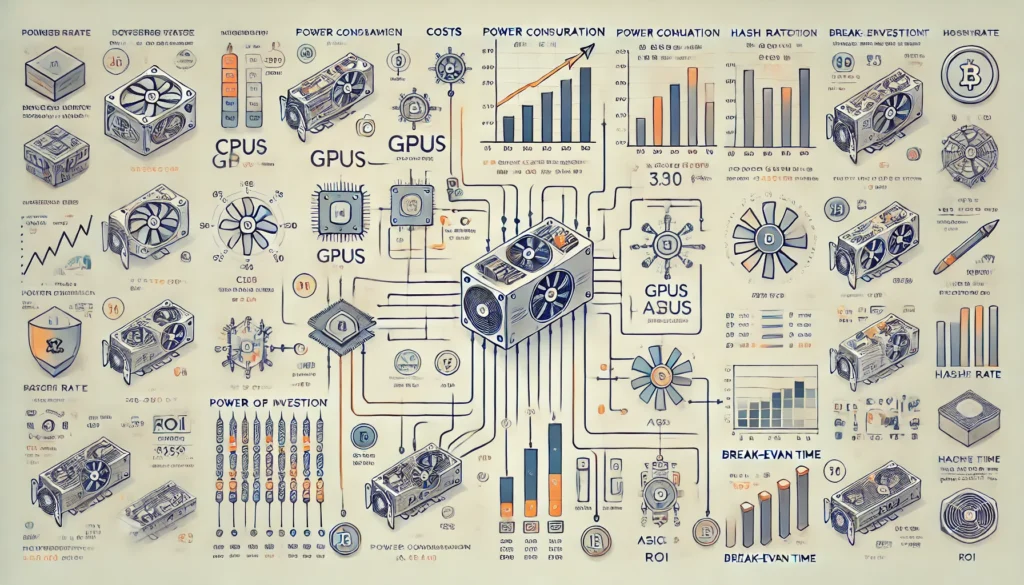

- ASICs vs. GPUs: ASICs (Application-Specific Integrated Circuits) are custom-designed for mining specific cryptocurrencies, like Bitcoin. They are highly efficient but can be costly, ranging from hundreds to thousands of dollars. GPUs (Graphics Processing Units), often used for altcoin mining, are more versatile but generally less powerful for mining than ASICs.

- Hardware Lifespan: Mining hardware depreciates over time, and newer, more powerful models are frequently released. Investing in the latest, most efficient hardware can improve profitability, but it’s essential to consider the long-term lifespan of each device.

- Maintenance and Replacement Costs: Mining rigs require maintenance to operate efficiently. Over time, hardware components may need replacement due to wear and tear, especially in high-performance setups where parts run continuously.

- Cooling Systems: Mining rigs produce significant heat, and cooling systems are often necessary to maintain optimal performance. Adding fans or air conditioning units is an extra cost but can extend the lifespan of your hardware.

Choosing the right hardware and planning for maintenance costs are critical to managing expenses and improving profitability over time.

[Section 3: Mining Difficulty and Hash Rate**

Mining difficulty and hash rate are additional factors that can influence profitability:

- Mining Difficulty: Mining difficulty adjusts over time based on the number of miners in the network. As more miners join, the difficulty increases, which means it takes more computational power to mine the same number of coins. Higher difficulty can reduce profitability, especially for smaller miners.

- Hash Rate: A higher hash rate allows miners to solve cryptographic puzzles faster, increasing the chances of earning rewards. More powerful hardware contributes to a higher hash rate, but it also requires a higher initial investment.

3.URL: : www.yourwebsite.com/profitability-factors-mining-electricity-hardware-costs

Mining cryptocurrencies can be a lucrative endeavor, but understanding the key profitability factors is essential to making informed decisions. The most critical factors influencing mining profitability are electricity costs and hardware expenses. Below, we break down these elements and their impact on mining operations.

Electricity is arguably the most significant cost for cryptocurrency miners. The energy required to power mining rigs and keep them operational 24/7 is substantial. Here’s how electricity affects mining profitability:

- Consumption Rates: Different mining equipment consumes varying amounts of power. For instance, high-performance Application-Specific Integrated Circuit (ASIC) miners can use up to 3,000 watts or more. The more efficient the miner, the less energy it consumes relative to its hash rate.

- Electricity Pricing: The cost per kilowatt-hour (kWh) can vary significantly based on location. Miners in regions with high electricity prices will face greater operational costs. For example, electricity rates in countries like the U.S. can range from $0.10 to $0.20 per kWh, while places such as China or Kazakhstan often have rates below $0.05 per kWh. These differences can dramatically affect profitability.

- Energy Sources: The type of energy used—renewable or non-renewable—can also impact costs. Many miners are now shifting towards renewable energy sources like solar and hydroelectric power to reduce expenses and environmental impact.

Optimizing Electricity Costs: Miners can maximize their profitability by operating in locations with lower electricity rates or by investing in energy-efficient rigs. Using off-peak energy or collaborating with energy providers to secure lower rates can further reduce costs.

2. Hardware Costs

The cost of mining hardware is the next major consideration. Here’s how it impacts profitability:

- Initial Investment: Purchasing mining rigs can be a significant upfront cost. ASIC miners, which are designed specifically for cryptocurrency mining, can range from a few hundred to several thousand dollars. For example, high-performance models like the Antminer S19 can cost over $5,000.

- Lifespan and Depreciation: Mining hardware does not last indefinitely. As technology evolves and more powerful miners become available, older models become less efficient and profitable. This depreciation affects both the resale value and mining returns over time.

- Maintenance and Repair: Beyond the initial purchase, maintaining hardware is essential for continuous mining operations. Cooling systems, fans, and other components require periodic servicing. Failure to maintain hardware properly can lead to downtime and reduced profitability.

- Hardware Efficiency: The efficiency of mining rigs, measured in joules per terahash (J/TH), is a critical metric. More efficient miners consume less power for the same amount of work, directly influencing electricity costs. Investing in energy-efficient models can yield long-term benefits even if the initial purchase price is higher.

Strategies to Manage Hardware Costs: Miners should compare different models to determine the best balance between price, performance, and energy efficiency. Second-hand rigs may offer a more affordable option, but it’s crucial to weigh their condition and potential lifespan

H2: How Electricity Costs Affect Profitability in Mining

- Regional Differences in Electricity Prices

- Calculating Energy Consumption for Mining Rigs

- The Impact of Energy Efficiency on Profitability

- Choosing Renewable Energy Sources for Cost Reduction

- Tips for Minimizing Energy Costs in Mining Operations

H2: Managing Hardware Costs to Boost Mining Profitability

Upgrading Strategies to Stay Competitive.

Initial Costs vs. Long-Term Gains

Evaluating the Lifespan and Depreciation of Mining Equipment

Comparing Different Mining Hardware: ASICs vs. GPUs

Maintenance and Downtime Costs

H2: How Electricity Costs Affect Profitability in Mining

- H3: Electricity Consumption Rates and Mining Equipment

- H4: Energy Usage of ASIC Miners vs. GPU Miners

- H4: The Impact of Hash Rate on Power Consumption

- H3: Regional Electricity Pricing and Its Impact

- H4: Comparing Global Electricity Rates for Miners

- H4: Case Studies: Low vs. High Electricity Cost Regions

- H3: Renewable Energy Solutions

- H4: The Role of Solar and Hydroelectric Power in Mining

- H4: Benefits and Challenges of Transitioning to Renewable Energy

- H3: Strategies to Minimize Electricity Costs

- H4: Utilizing Off-Peak Energy Hours

- H4: Partnering with Energy Providers for Discounts

H2: Managing Hardware Costs to Boost Mining Profitability

- H3: Initial Investment and Cost-Benefit Analysis

- H4: Comparing ASIC and GPU Mining Rig Prices

- H4: Evaluating ROI on High-End vs. Budget Mining Equipment

- H3: Depreciation and Resale Value

- H4: Understanding Hardware Lifespan in a Fast-Evolving Market

- H4: Strategies for Selling or Repurposing Used Mining Rigs

- H3: Maintenance and Operational Efficiency

- H4: Routine Maintenance Practices to Prolong Hardware Life

- H4: Importance of Proper Cooling Systems

- H3: Upgrades and Technology Advancements

- H4: When to Upgrade to Newer Mining Hardware

- H4: Weighing the Costs of Staying Updated in the Mining Industry

For a comprehensive analysis of cryptocurrency mining’s energy consumption and its implications, refer to the research paper “Energy Consumption and Bitcoin Market” published in the Asia-Pacific Financial Markets journal.

SpringerLink This study explores the relationship between Bitcoin’s energy usage and market dynamics, providing valuable insights into how electricity costs influence mining profitability.

Sources

Conclusion

Electricity and hardware costs are the most significant profitability factors in cryptocurrency mining. By understanding and managing these elements, miners can optimize their operations for better returns. Reducing energy expenses by choosing efficient power sources and investing in high-performance, cost-effective mining rigs can lead to sustained profitability in a competitive market.

Miners looking to maximize their earnings should consider both the short-term and long-term implications of electricity and hardware investments. Planning and strategic choices are key to staying profitable in the dynamic world of cryptocurrency mining.

comprehensive guide on cryptocurrency mining basics.”

comparing mining hardware and their costs.”

mining vs. staking and their profitability factors.”

energy-saving strategies for cryptocurrency mining.”

Links

SpringerLink This study explores the relationship between Bitcoin’s energy usage and market dynamics, providing valuable insights into how electricity costs influence mining profitability.

Sources

Maximizing Mining Efficiency with Cost-Effective Strategies.www.Profitability Factors in Mining (Electricity, Hardware Costs)2024 Sustainable Essential.com

Read more: Profitability Factors in Mining (Electricity, Hardware Costs)2024 Sustainable Essential